Closing Out My Top "Call": American Express

Reflecting on a 344% return and why future options look too risky

Nearly two years ago, I did my first scoreboard update and revisited my decision to ignore American Express. New data had emerged, transforming the numbers from "blah" to quite nice. This reevaluation led me to model the stock price at $230-$255 per share by January 2025 (which is now—yay!) for a projected return of 71%-162%. With the position set to expire in less than two weeks, it’s time to close it out. The underlying stock is currently trading at $303, delivering a whopping 318% return. Let’s review how my predictions for the stock price and returns held up, and then explore what future opportunities may hold.

Past Predictions

When I first analyzed American Express around Thanksgiving 2022, I didn’t like what I saw. However, based on new information released in January 2023, I changed my stance and identified an option for the scoreboard. The company’s updated guidance for 2023 projected earnings that surpassed what I had expected for 2024, effectively accelerating my growth assumptions by an entire year.

In my re-evaluation, I forecasted a stock price range of $230-$255. I extrapolated my earnings per share (EPS) estimate from the company’s guidance, targeting $12.88 for 2024. American Express is now on track to deliver $13.35 in EPS this year, exceeding my expectations.

To predict the stock price, I used the valuation metrics at the time: a price-to-earnings (P/E) ratio of 17.9 and the five-year average P/E of 19.8. This approach gave me the following range:

So, why is the stock trading for so much more than expected? For one, the company performed better than I had anticipated, with earnings on pace to exceed my estimate by ~$0.50 in 2024. Additionally, it’s trading at a higher valuation than it has in a very long time—currently at a P/E ratio of 22.40, well above the five-year average of 18.2. This elevated valuation has made our returns for this play fantastic, but it also suggests that future plays may carry significant risk. A reversion to the mean could lead to a wipeout. We’ll explore that in more detail later.

Back in January 2023, I examined the options available and showed:

We were able to secure the $185 strike price at a cost of $26.65, which offered potential returns of 71%-162%. I thought that was very achievable and added it to the scoreboard. The company is now valued at a higher rate due to the strong growth over the past two years and expected growth for the next two. This shift in valuation significantly impacted how the stock trades and resulted in fantastic returns. The $185 strikes now trade for $118.38, delivering a return of 344%.

This has been the top-performing position for Rolling Thunder and one I couldn’t have fully anticipated—that’s just how the markets work sometimes. When a company is valued higher than its recent or historical averages, it can dramatically boost your returns. I’m officially marking this position as closed after today.

You’ve been good to us, AMEX!

The Future

What about future LEAPS? Could they work as a Rolling Thunder option? Let’s first examine the earnings potential for 2026 and then build an expected stock price based on that projection.

For 2025, the consensus estimate for American Express is earnings of $15.18 per share. Looking ahead to 2026, the eight analysts covering the stock project earnings of $17.16 per share, with estimates ranging from a low of $16.49 to a high of $17.40. Additionally, other sources suggest the market is expecting a 3-5 year earnings growth rate of 7.5%. This is significant because if the growth rate is slowing—or expected to slow—the valuation of each dollar earned by the stock will likely decrease.

To account for potential variability, I’m using a slightly lower number than $17.16 for my estimate, as the final quarter of 2026 won’t be fully logged before the option expires. For simplicity, I’ll subtract $0.50 from the low, mid, and high estimates, given the ~$2.00 per share growth projection for 2026.

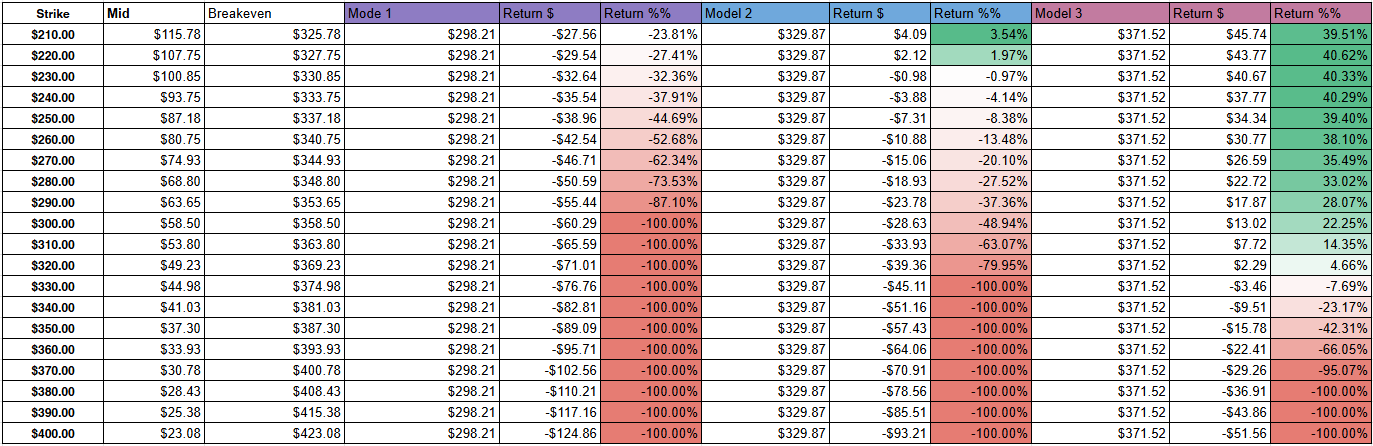

Using the earnings numbers and P/E ratios from different periods—17.9 from the lower-growth days of 2022, the historical average of 19.8, and today’s 22.3—we can model the future likely stock price to be between $298 and $371.52. This projection obviously isn’t great, considering the stock is already trading at $303.

But how expensive are the options? Perhaps there are some strike prices with decent upside potential that justify the risk of the stock trading sideways.

The implied volatility is higher than I’d like to see for a typical LEAP. However, using the projected stock prices for the Calls, I can build out the table of potential returns below:

I’m not going to sugarcoat it: this is an ugly table. Unless today’s P/E ratio holds steady, these options will almost certainly lose money. Even if the P/E ratio remains high and everything goes well, you might only see a ~40% return, compared to a 30% return from the underlying stock. That’s a bad deal, given the potential for a wipeout with the option.

I really like American Express as a company and would strongly consider keeping or investing in the stock itself. However, as for the options, it’s best to shy away from them for now. No new position will be added to the scoreboard. I’ll continue to keep tabs on AMEX, though—it remains one of my favorite companies. If conditions change, I’ll let you know, and we may revisit buying options.

Summary

That’s all, folks. Two years later, we’re closing the original American Express position as it expires in two weeks. It has been our top performer, thanks to the way the market valued the underlying stock. With a 344% return in just under two years, I couldn’t be happier.

Unfortunately, the same factors that made this a top performer also make future options look rather bleak. The best-case returns aren’t much better than simply buying the underlying stock, which doesn’t justify the wipeout risk. If you bought into this position, remember what I’ve said about tax implications: you can exercise the option, hold the underlying stock, and defer taxes until you sell those shares.

Lastly, no new items for our scoreboard this time. Thank you for reading, and be on the lookout for my next post!

Regards,

S. Andrew