Background

So, it has been a crazy few months and I haven’t been writing new posts, so this is overdue - here it is. An update on the boards and thoughts on value going forward. A schedule I am hoping to keep, and a list of stocks I plan to cover.

Updates on Credit Cards

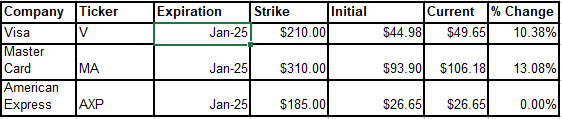

I wrote 3 posts before thanksgiving evaluating three of the major credit card companies in the US: Visa (V), Mastercard (MA), and American Express (AXP). While I standby my positions and projections for Visa and Mastercard, I do need to revisit AXP.

AXP gave its end of the year results last week which were solid, and updated their guidance for 2023. What did they say? That they are expecting earnings for the year to be $11-$11.4, Revenue Growth for the foreseeable future of >10% and mid-teen levels of EPS growth for the foreseeable future. IF we look back at our old table:

That puts Amex on path to hit what I expected next year this year, and a growth rate higher than predicted. Instead of $11.41 being the EPS for our projections I would now calculate $12.88, using the middle of the EPS range 11.2 with a mid-teens growth rate of 15%. I would also update the PE Ratios for the projections to use today’s 17.9 along with the previous 19.8 as the historical PE. This would find us looking at:

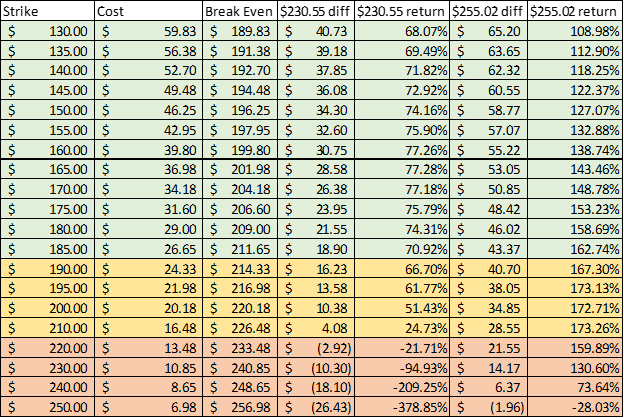

And with the updated costs to options and those numbers the possibilities great even with the jump in share price:

So I will be humble and leave AXP on the ignore board to keep myself accountable, but with current information I will also be adding an entry onto the score board using the $185 strike price.

A Final point to reiterate – Things change, they always will. When they do – re-evaluate and make the best decision possible from that point forward. My original assessment used the data of the moment, it is perfectly fine to make a new assessment with new data.

Schedule

I will be moving to a Monday release going forward, with a post to be sent out every Monday whether it be a new breakdown or something else. If I have more to say I will add to that, but you won’t have another 2 months’ silence from me.

What’s Next

Coming up will be coverage on some Big Tech companies, Big Oil, a look forward on the big pharma stocks that drove past returns and places to gain from inflation ebbing. Inflation numbers will look far better in the next few months based on the fact that oil prices are down significantly from where they were a year ago. This will re-arrange valuations on many stocks vulnerable to interest rates. Oil prices are still hovering around $80 a barrel which is a place they haven’t held consistently since 2014. This means that many companies in that space will see their valuations increase as they sustain larger profits. The next company we will evaluate is Alphabet and if you aren’t sure what they make, Google it.

S.