Background

From them: “American Express (NYSE: AXP) is a globally integrated payments company that provides customers with access to products, insights and experiences that enrich lives and build business success. Our integrated payments platform includes card-issuing, merchant-acquiring and card network businesses. We are a leader in providing payment products and services to a broad range of customers, including consumers, small businesses, mid-sized companies and large corporations around the world.

Founded in 1850 and headquartered in New York, American Express has a heritage built on service and sustained by innovation. American Express® cards issued by American Express as well as by third-party banks and other institutions on the American Express network are accepted at millions of merchants around the world.”

From me:

The granddaddy of credit cards themselves it is American Express! Curator of the cards most likely to not be accepted places. They too process credit card payments but do it in a different way than our previous two issues: they charge more. A lot more. This means some that AXP makes more per time you swipe one of their cards, but they tend to grow slower than Visa or Mastercard. They also tend to trade at a cheaper valuation.

Graph

Valuations

As of EOB yesterday you can buy a share of AXP for $152.81. Over the past 10 years things have gone from about $50 a share to $150, turning each dollar invested into 3. This is where you can see that growth difference mentioned above. Still a great return, but half that of its peers. TTM earnings are $9.95 with a PE of 15.3. Like the other credit card companies, this is similarly below the 5-year average of 19.8. Inflation fears, and real borrowing rates going up do have a real impact on these companies and are why things have come down. For extremes the PE has gone as low as 9.7 and as high as 31.3 in the past 8 years.

So, what does that mean?

Like everything else this fall, uncertainty is in the air. Will things get better? Will the fed win in its question to get us back to low inflation? I think it will. Especially given the fact that everything discussed in this newsletter is 2 years out. That is a lot of time to fix things. 23 expert analysts cover American Express and average out to be expecting $10.56 per share of earnings for the year ending 12/31/23. Of those 23 analyses the lowest estimate is a measly $6.94 and the rosiest is $11.65. They also project a 7.5% EPS growth rate for the next 3-5 years. Using that to give us the rails for 12/31/24 we are going to apply the 7.5% growth factor and have a low of $7.46, an average of $11.41 and a high of $12.52.

Projections

So here is my chart on the best and worst cases. A quick look at what could be.

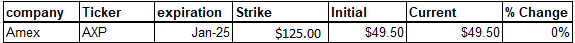

Options

A look at the options for 1/2025. For any strikes that had a last withing the bid/ask I used that number, otherwise I used the middle. These are from the end of the day on 11/21/22.

Outcomes

Now the big and the important chart, what the returns may be. Returns will be calculated off the $11.41 EPS estimate and use the 15.3 and 19.8 PEs.

What is apparent from this is that growing earnings at a stable PE valuation will not give a good return. One thing seen between the big three credit card companies is the IV is pretty much the same for them all, meaning they are all about the price (as far as valuing options). With Visa and Mastercard there is a good return possible from underlying earnings growth at the forward estimate with a steady valuation. Then there is big upside should PE expand again. American Express has no such situation and will only be worthwhile should PE expand. For this reason, it will be the first entry onto our Ignoreboard.

I hope this gave you some things to think about,

S.