Visa Revisited

Going Back to the Well

Visa Revisited

In November 2022, I released my inaugural post titled "Visa (V) - Exploring Our Options." Within that piece, I analyzed potential trajectories for the stock. Now, I'll provide a brief overview of the outcomes and delve into future perspectives once more.

Today

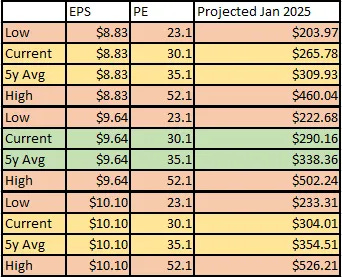

Presently, Visa is trading near $258 per share, accompanied by a Trailing Twelve Month (TTM) PE of 31.18. A year ago, its value stood at $210 with a PE of 30.1. Closing the year 2023 at $8.68 in earnings (compared to $7.00 in 2022), Visa is now anticipated to reach $9.89 in 2024, exceeding the earlier projection of $9.64 when I initially covered the stock.

Analysts currently foresee a more moderate earnings growth rate of approximately 14% over the next 3-5 years, compared to the 16.75% predicted a year ago. This adjustment could be attributed in part to the robust 24% growth witnessed in the past year (from $7.00 in 2022 to $8.68 in 2023), with expectations of a slower pace in the years ahead.

In summary, Visa has delivered on its promises, the economic landscape appears more optimistic than anticipated, leading to both earnings surpassing expectations and a PE valuation expansion. A year ago, I illustrated the stock's trajectory with the chart below.

Today I would tighten this up significantly to:

Anticipating a potential Fed interest rate cut next year, there's a chance the PE could expand in response. However, it seems unlikely to reach a 35 PE for Visa, especially considering the 5-year average PE dropped to 34.3 in the past year. Given Visa's widespread coverage and consistent track record, earnings are expected to align closely with the consensus. It's worth noting that despite analysts' average price target of $284 a year from now, recent Fed activity hasn't been factored into those estimates.

TL;DR: Considering these factors, I would assess our potential range for the next year as $284-$321.

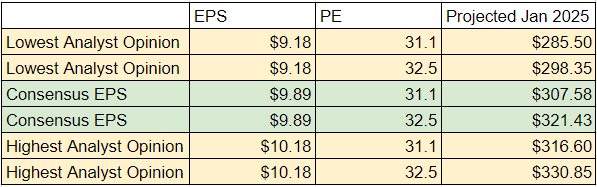

The Leap

Last year, I initiated Visa options at the $210 strike with a cost of $44.98, marking the first entry on the scoreboard. As of the current writing, that particular option has appreciated to $63.50. This translates to an impressive 41.2% return in slightly over a year if the option were to be sold. Notably, we've also surpassed the break-even point with a year still remaining—an exciting double win! The following outlines the potential outlook for the next year based on the aforementioned projections:

Considering this, my personal inclination would be to retain this option for the upcoming year. There are numerous pathways to further gains, some of which could be substantial. I understand you might be wondering, "What if I want to buy January 2025 options still?" or "Should we explore the 2026 options as well?" To both, I'd say, "Absolutely!" However, before delving into that, it's crucial to maintain a clear scorecard. I'll keep the Visa $210 strike on the scoreboard. In an alternate scenario where we had already secured more gains, an early exit might be on the table.

Next up: a reassessment of the 2025 LEAPs, followed by an exploration of the 2026 options!

2025 Leap Update

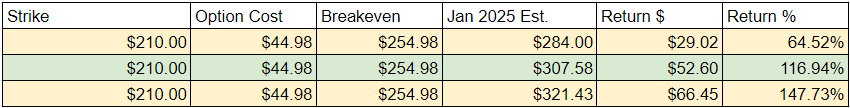

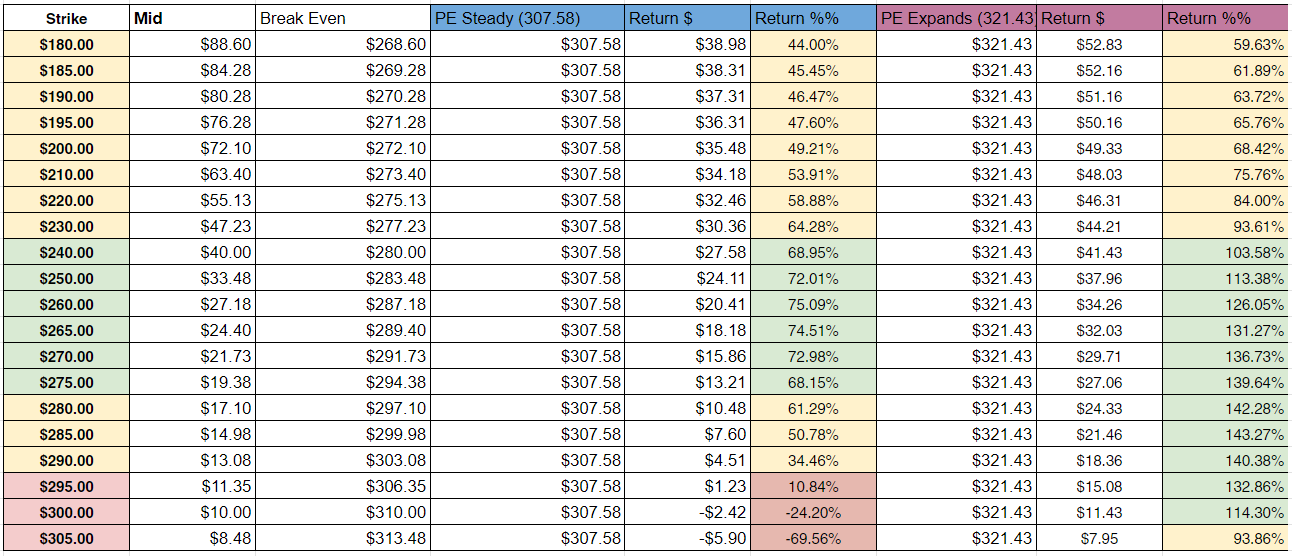

Looking at 2025 options at the close of today 12/18/23 we see:

Our friend on the scoreboard is the $210 Strike. So what if we check those against our updated projection of $307-$321? How does the $284 look, Who cares! I will go with my numbers for this one because if I evaluate three prices the chart gets huge. You can see that in a later chart. The thing you need to know is that at $284 most of the 2025 options return 10-17%, not much different than buying the underlying stock with plenty more risk.

It seems that within the $307-$321 range, most of these options would yield robust returns. Notably, the $210 option has shifted into the yellow category. Purchasing it today might result in a slightly lower return compared to some other options, but the difference isn't substantial. You have the option to minimize churn and taxes by maintaining it as is. Alternatively, selling it at around $63.40 and reinvesting in options within the green strike range could theoretically generate the highest return. With more than a year left, we can keep things within the long-term capital gains territory.

To add a bit of excitement, I'll introduce the $260 strike to the scoreboard. If purchased a year ago at $24.50, these options would have yielded a modest ~11% return so far. Now they have the chance to be an easy double.

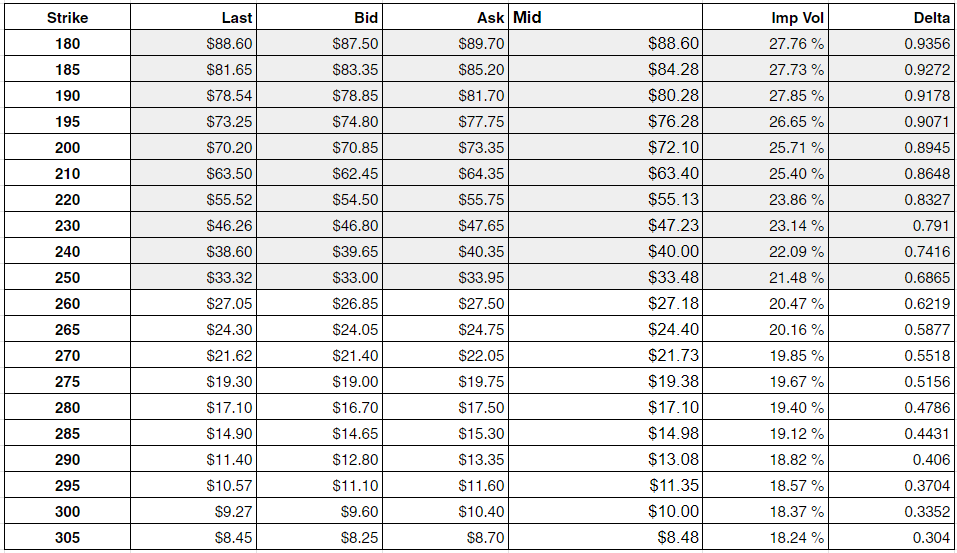

2026 Leap Outlook

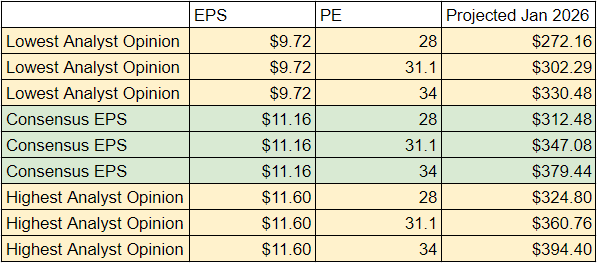

Visa is anticipated to sustain robust growth in 2025, with an estimated EPS range of $9.72 to $11.6. The consensus leans towards the optimistic side, centering around the magic number of $11.16. Extending the outlook to two years, I would reconsider the PE range we use to evaluate Visa, considering the potential for changes. The range could contract towards the lower 28 PE, or perhaps expand further towards the 35 PE seen in low-interest years (though this seems less likely). Given the 5-year average PE now standing at 34.3, I've opted for a slightly optimistic estimate of 34 in my analysis for the upper end.

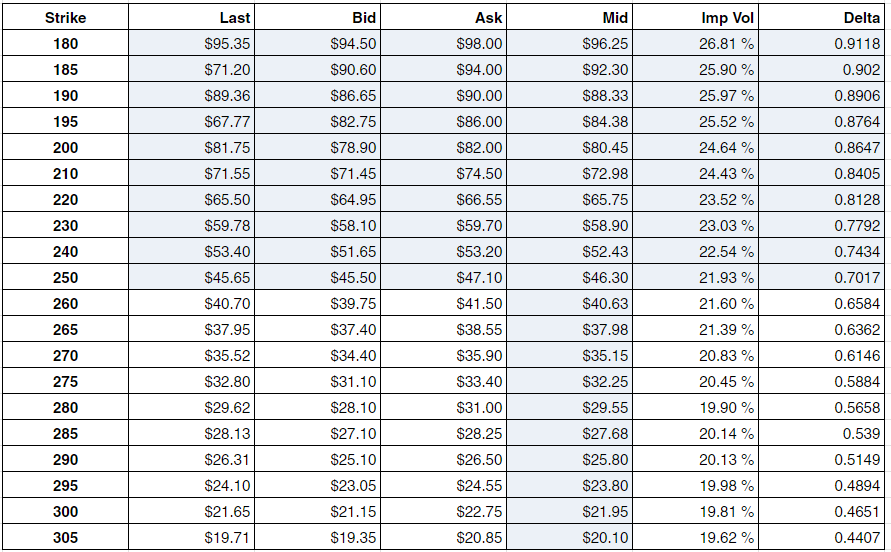

Now let’s see what those 2026 LEAPs are priced.

**Taken midday 12/18/23

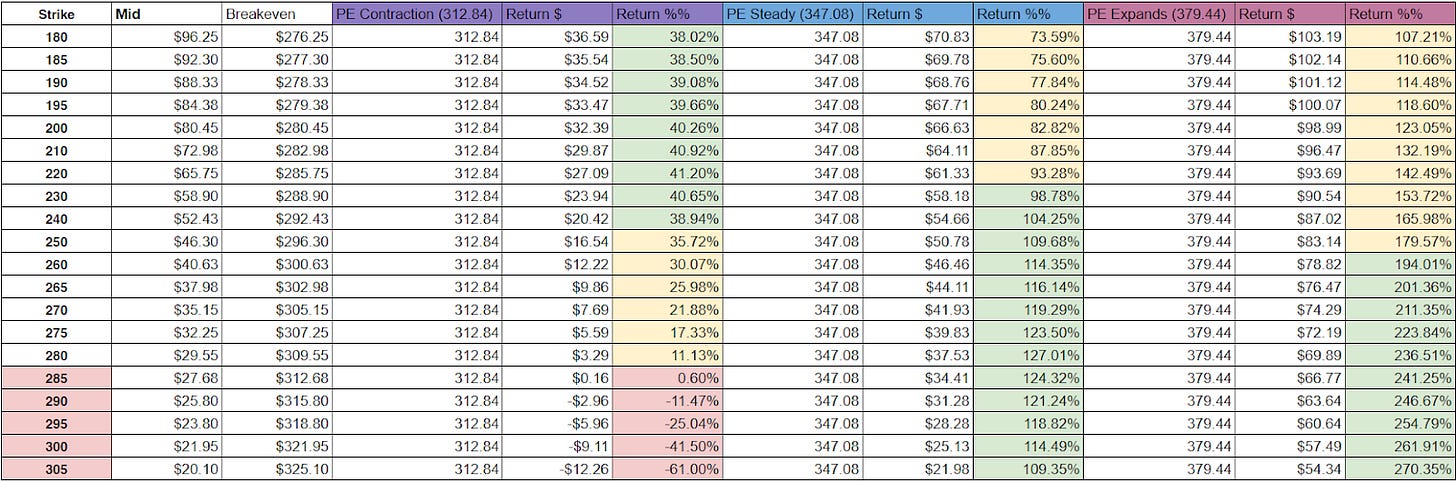

Look at all those great choices! Now do they have potential for outsize returns? Let’s see! Apologies about how wide this chart is. It is a hefty one.

I've color-coded each outcome to highlight the best returns in green, less optimal returns in yellow, and losses in red. If Visa is trading around $312 by January 2026, the highest strikes would result in a loss and are thus ruled out. The return curve for more positive outcomes favors starting at the $260 strike, which still yields around a 30% return in the worst-case scenario. Despite the potential for better returns with higher PE ratios, the $260 strikes and above may see diminishing returns or even losses in the worst-case scenario. Therefore, I consider the $260-$280 range to be optimal, and for our scoreboard, I'll choose the $260 strike. This maintains symmetry with the 2025 revisit, and even in a scenario with a shrinking PE, it still yields a 30% return over two years.

Similarly, as mentioned earlier, I wouldn't be opposed to locking in some gains from our existing Visa option this year or the next and transitioning to the $260 strike. This approach allows for taking some profits off the table while positioning ourselves for a potentially greater return.

Summary

Visa is truly a rockstar, offering various pathways to investing success. Even if you're not a fan of options, investing in the underlying stock can prove lucrative. I intend to share the updated scoreboard this week, featuring two new Visa options alongside the original one. Happy investing!

Regards,

S.