Over the past year since I wrote about UnitedHealth Group (UNH) options, the stock price had risen ~20%, from $520 to $620, delivering our options a tidy ~50% gain and putting the position solidly in the money. With a year of runway left, everything seemed on track for my prediction of $680 to $711 by January 2026.

Then came Luigi Mangione and the shocking murder of UnitedHealthcare CEO Brian Thompson. The stock took a 10% hit, and in the aftermath—as people shared their rage stories about the company—it fell another 10%. Adding to the turmoil, Trump tweeted something that hinted at potential action against UNH and other similar middlemen.

That brings us to today, where the stock is set to open at $514 per share—$6 lower than its price a year after my initial write-up.

This presents a unique opportunity as an investor. While the public outrage is real—and there are certainly plenty of reasons to dislike your insurance provider—there simply aren’t many alternatives. The business fundamentals behind UNH remain unchanged from a month ago, and it is likely to continue growing as expected. Furthermore, once this issue fades from the headlines, I have zero expectation that new rules or regulations will result from this event or Trump’s tweet. When this is all behind us, UNH will be the same company it was two months ago, last year, and in years past: a mega-cap healthcare giant making gobs of money from our expensive healthcare system.

Looking to January 2026

For the initial batch of options I wrote about, the expiration date was January 2026—just over one year from today. At the time, I had to extrapolate earnings estimates to build my share price model. Things were expected to come in at $27.91 earnings per share (EPS) for 2024, and I extrapolated that to $31.47 based on the anticipated growth rate.

Instead, 2024 EPS is now projected at $27.64. With updated data, we now have 26 analysts covering the stock, projecting 2025 EPS at $29.85, reflecting more modest single-digit growth for the year. Additionally, the 3-5 year expected growth rate has declined from 12.75% to 11.5%.

Using my original EPS estimate and the historically tight P/E ratios within which the stock typically trades, I created the table below:

This needs to be updated now. With 26 professional firms covering the stock and projecting EPS between $29.25 and $30.95, and a consensus estimate of $29.85, I need to revise the EPS in my model downward. I’m also considering adding another valuation to the table, as things may be more volatile in the year ahead.

Currently, UNH is trading at a P/E ratio of 18.67, while it has historically traded around 21.9. Some recent readings, particularly over the past year, have been skewed by one-time expenses in Q1 of 2024. However, those adjustments will be phased out of the metrics in a few weeks.

On the higher side, when conditions are favorable, the P/E ratio can trend up to 24. Normally, I would tighten my valuation window as the expiration date approaches. In this case, however, I’m including a range that accounts for today’s depressed valuation (18.7), the historical average (21.9), and a best-case scenario where pessimism gives way to euphoria (24).

This results in the following updated table of price-to-earnings valuations:

I truly believe we’re living in a world influenced by a manic Mr. Market, and I don’t think the lower P/E ratio will persist. My expectation is that UNH will likely trade in the range of $653 to $716 by January 2026.

Don’t just take my word for it—the 20 firms covering UNH have set a 12-month target price of $643 for the stock. With this in mind, I’ve looked at the current cost of options and modeled out potential returns from there:

We can see that the implied volatility (IV) is higher than it was a year ago, indicating that these options are relatively more expensive and that the stock is volatile. Which… it is.

Taking the modeled stock prices and the options as they stand pre-market on 1/6/2025, you can see the potential returns above. Since the stock opened ~$2 per share higher, all the returns will be slightly worse after today. As I mentioned, I expect the $653-$716 range to be the most likely outcome. If that happens, most strikes would double or triple, with a small additional return the further out of the money you go in the highest valuation scenario.

Looking at this, I’d probably target an in-the-money strike, as the worst-case scenario results in steeper losses the further out of the money you are. With that in mind, I’m adding the $480 strike to the board. It offers a double to nearly triple return in the likely stock price range and only a manageable 10% loss in the worst-case scenario.

For the original LEAPS I added to the board—the $550 strike from a year ago at $64.38— it is now worth $51.70, reflecting an ~20% loss on paper. I would hold this position, as it still has the potential to double or triple by expiration.

However, if you’re concerned about the potential for a wipeout from being further out of the money, you might consider rolling into the $480 strike. This offers a similar return profile with less downside risk.

New LEAPS - 2027

Looking past 2026, what does the future hold for options expiring in January 2027? Another year of growth should be in store for UNH, which means the stock price is likely to trend higher. Using the projected earnings growth rate of 11.5%, I estimate that by January 2027, earnings will range between $32.61 and $34.51. From there, P/E ratios will drive the stock values outlined in the table.

Once again, I expect a reversion to the mean, with the 21.9 P/E ratio being the most likely valuation. That will be the column I focus on most when evaluating options.

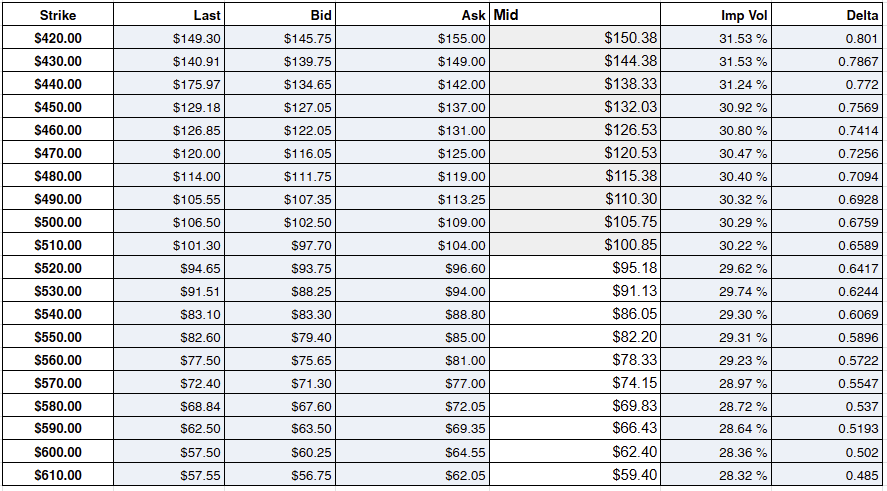

Speaking of which, how do those 2027 options look? (As of pre-market on 1/6/2025.)

It’s pretty similar to the above in some ways, with higher implied volatility (IV) than last year. Using this to model returns, we arrive at the following table:

This shows an eventual loss in what I view as the worst-case likely scenario, starting at the $540 strike price. In the most likely scenario, nearly all strikes double, with little difference by strike. There is a gradual but small increase in returns as you go further out of the money in the best-case scenario, where most strikes approach triple returns.

For this expiration date, I prefer the $520-$540 strikes. They provide ~120%-190% returns in the better scenarios, and in the worst-case likely scenario, they still break even. That’s a tradeoff I’m willing to make. To pick one item for the board, I’m going with the $520 strike. When things are close, I prefer having more paths to being in the money, so I lean toward the lower strike price.

Summary

UNH is giving us a chance to secure last year’s prices today, creating plenty of good LEAP candidates. I’m adding two new positions to the scoreboard to reflect this:

2026 option: $480 strike for $86.85

2027 option: $520 strike for $95.18

Both offer decent odds for doubles to triples and I view the downside risk as acceptable. As always, if you find this intriguing, take a deeper look, share your thoughts, and pass this along to a friend.

Thank you for reading.

Happy investing,

S. Andrew