Mercky Christmas, everyone!

It’s that time of year again—snow is in the air, the chorus of jingle bells fills your ears, and my rundown of Merck is in your inbox.

Last year, I posted a rundown of Merck and added it to the scoreboard. In that post, I highlighted the $105 options trading for $15, with a breakeven of $120. As of now, those options have lost approximately 34% of their value. Most of the year, these options were up significantly, and I fully expect them to be again soon.

Long story short, I’m still bullish on Merck. This piece will break down why, what 2026 looks like from here, and what 2027 may hold.

Since December 2023…

Last year, Merck was sitting at $105 per share. This weekend, it is trading at $103 per share. The chart above shows Merck’s performance over the past five years.

This past summer, Merck reported lower-than-expected numbers for its Gardasil vaccine in China, sending the stock tumbling. That decline has persisted into the fall, despite Merck's overall financial picture remaining largely unchanged.

When I modeled Merck’s expected January 2026 stock price last year, I used a 2025 earnings projection of $9.37. I built this estimate using the consensus 2024 earnings expectations at the time and applying my expected forward growth rate.

Today, with 2024 nearly behind us, Merck is projected to earn a consensus $9.43 in 2025, based on estimates from 20 analysts (low: $8.35, high: $10.24). A year closer, the major firms are now providing their numbers. My original estimate was within $0.06 of the current consensus average—a year before those numbers were released.

Last year, using a similar midpoint estimate, I projected the stock would trade at the following values by January 2026:

I anticipated that trends would continue in the direction they are still heading. However, I used the full-year estimate last year when I should have accounted for one final quarter of growth. A more cautious set of numbers, recalculated today based on trailing P/E, looks like this:

These figures are pretty typical for Merck based on its trailing 12-month P/E ratio and show a similar range to what I projected a year ago: $126–$153.

I also wanted to evaluate the stock using a forward P/E perspective, as it can sometimes provide a different lens. This approach is particularly useful in situations like this, where Merck has rapidly lost 30% of its peak value.

Using forward P/E to model, we arrive at a different range when looking at 2027 estimates:

Either way you slice it, you end up with a similar range of expected stock prices. I think of this more as a heatmap, where the most likely scenarios overlap, defining the range to consider.

Based on current numbers and projections, I would base my decision on the likely trading price of $126 while evaluating the upside at $153 and $168, depending on which P/E direction you prioritize.

Lastly, looking at professional analysts’ targets, the average is $130 per share for 12 months out, with a range of $110–$150—closely aligning with the ranges above. I believe $110 represents a safe floor for the worst-case scenario, which is worth considering when evaluating the breakeven price for options.

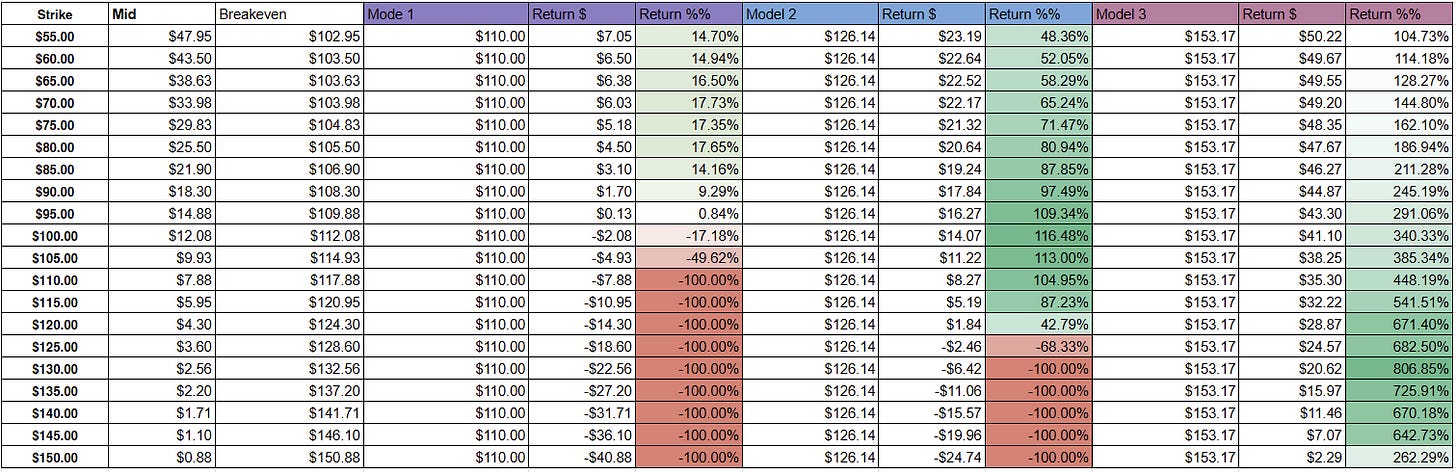

With these potential outcomes in mind—$110, $126, and $153—we can assess the possibilities. For the $168 "gangbusters" scenario, expect results similar to the $153 outcome but amplified.

In this case, I would focus on $126 as a quite likely trading price for 2026 and direct my attention there. It’s worth noting that, with good news and this being a potential “dip,” we could see a huge year where those higher stock prices with gaudy returns come to fruition.

To that end, the $90–$115 strikes all offer the potential to double in a single year, with anything exceeding my expectations going exponentially higher. If the stock remains undervalued and trades at $110 next year, the $100 and under strikes would likely get you your money back, while the $105 strikes would lose about half their value. Anything above that would be a wipeout.

In a $153-per-share scenario, outcomes improve as you move down the board, peaking at the $130 strike. However, at $126 per share—the price I consider most probable—the $130 strike would be a wipeout.

I plan to add the $100 strike to the board. It represents a break-even in my viewed worst-case scenario, with a double to quadruple return in the more likely favorable outcomes. I will also add the $120 strike. While riskier, it offers a significant return if the stock performs exceptionally well—a 43% return even on my most likely path.

Looking to January 2027

Now, let’s look further out. This extended timeline allows for short-term market sentiment to smooth into long-term evaluations and provides more time to get things right. While the 2026 options could offer significant upside quickly due to the current dip, the 2027 options might be the safer play. They allow more time for events to unfold while maintaining a similar return profile.

Additionally, 2027 offers Merck time to extend the patent protection on its biggest seller, Keytruda. The patent is currently set to expire in 2028, but there are potential paths to extend it to 2034. If these extensions become viable, they could drive more value to the underlying stock.

Merck is projected to earn a consensus $10.46 per share in 2026, with a high estimate of $11.09 and a low estimate of $9.57. This represents approximately a dollar more per share than 2025 and a healthy >10% EPS growth.

For modeling purposes, I account for the trailing 12-month P/E, which excludes the final quarter of growth due to the timing of earnings reports. Therefore, I’ll adjust my estimates down by approximately $0.25 for a more accurate model.

Using these numbers, I would expect Merck to trade in a range of $143–$173 by December 2026 or January 2027. If we assume valuations remain exactly as they are today, using the forward P/E measure and the far-off, somewhat uncertain 2027 EPS projections, the worst-case value comes out to $122. However, I don’t view this scenario as very likely given the two-year horizon.

Instead, I will model returns for the 20 strikes closest to the money, based on scenarios where Merck trades at $143 and $173:

Looking at the range I’m targeting for Merck’s underlying stock price, there are excellent opportunities in the two-year-out options. At $143, almost all the options are winners, with the $105–$120 strikes standing out for nearly 200% returns. At $173, the further out-of-the-money you go, the better the upside becomes. This makes me particularly bullish on the $115 strike—it would triple at $143 and 6x at $173.

I’m also open to strikes in the $90–$135 range. The lower strikes offer less return but a lower breakeven point, while the higher strikes deliver considerably more upside if things go well. I will add the $135 strike to the board as it offers substantial upside with an acceptable return at the lower end of the expected range.

Summary

Merck is undervalued, creating strong opportunities. A year ago, the setup looked similar, and Merck has delivered on a fundamental basis. However, due to shifts in market sentiment, it is currently trading 30% below its recent highs.

I expect significant stock appreciation over the next two years, making this a target-rich environment for LEAPs. To that end, I’ve added four new positions to the scoreboard:

2026 Options:

A traditional play with good upside and limited downside.($100 strike)

A higher-risk, high-reward option. ($120 strike)

January 2027 LEAPs:

A safer play with solid potential. ($115 strike)

A higher-upside play for aggressive investors. ($135 strike)

I hope this analysis gives you some new ideas to consider.

Happy investing,

S. Andrew

*Nothing sent out is meant to be financial advice, invest at your own risk.*

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and does not constitute financial or investment advice. Options trading involves significant risk and is not suitable for all investors. It is possible to lose all or more than your initial investment. Please consult with a licensed financial advisor or other qualified professionals before making any investment decisions.

Assume the author currently holds options positions in all the securities discussed in posts or listed on the scoreboard. These holdings may influence the opinions and analysis presented in this newsletter. This disclosure is provided to maintain transparency and should not be considered a recommendation to buy or sell any securities.

Any projections, forecasts, or examples provided are hypothetical and for illustrative purposes only. Past performance is not indicative of future results. While every effort is made to ensure the accuracy of the information, it is not guaranteed to be complete, accurate, or up-to-date.

Links to third-party websites are provided for convenience only. The author does not endorse or take responsibility for the accuracy of third-party content. All models, tools, and content provided are for personal use only and may not be reproduced, distributed, or used for commercial purposes without permission.

The author assumes no responsibility for any losses incurred as a result of using the information provided in this newsletter. By reading this newsletter, you agree to these terms.