Mastercard Revisited

Even better than before?

Where are we now?

Similar to Visa, Mastercard was highlighted in November 2022. I included the $310 strike, which cost $93.90, in the scoreboard at that time. The scoreboard update revealed its strong performance, but now let's examine the underlying stock's performance over the past year:

Over the past year, the stock has risen from $343 to $421, reflecting a gain of 22.7%. Initially anticipating 2023 earnings at $12.18 per share, the current estimate hovers close at $12.17. My speculative estimate for 2024 stands at $14.74, differing from the consensus of the 36 analysts, who project $14.24 for the upcoming year (ranging from $13.21 to $14.64). This variance serves as a basis for projecting the next year. As for Mastercard's present valuation, it currently boasts a trailing twelve-month PE of 36.5, up from 34.3 a year ago but still below the four-year average of 39.9 (which itself is a decrease from last year's 41.5).

New 2025 January Estimate

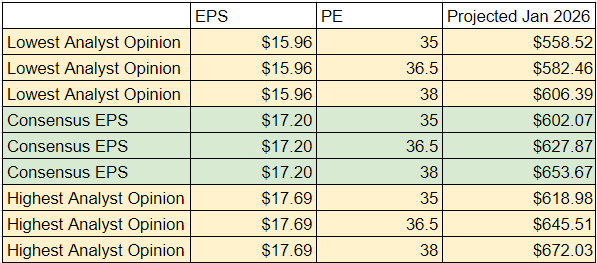

Anticipating a decrease in inflation and a corresponding reduction in interest rates by the Fed, I see a probable expansion in the PE, although not reaching the 39.9 five-year average. I'll consider 38 as the upper limit for our new estimate. By considering the professional analysts' low, high, and consensus EPS, we can outline a range of likely outcomes for Mastercard.

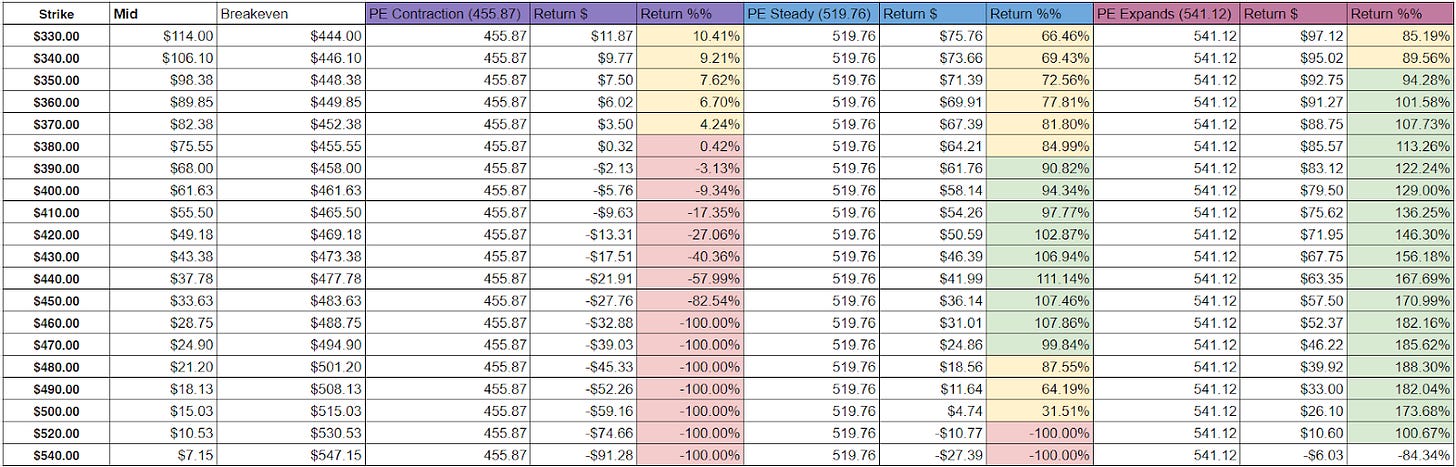

We can see now that the tighter range to value mastercard in would be $519.76 to $541.12. The analysts covering the stock have a 12 month target of $455.87 which is lower, but could be adjusted once the next set of earnings are reported. Using those three values the range of outcomes for next year looks like:

If the stock reaches the target price of $455.87, the option would yield approximately $52 on the initial investment of around $94, resulting in a 55% gain over two years. While this is respectable, it's not exceptionally great compared to the current 45% position. However, if the market trends align with my earnings-based estimates, the scenario becomes much more favorable—potentially doubling our option.

Nevertheless, it's crucial to acknowledge that nothing is guaranteed. Just as I did with the Visa reassessment, let's examine the available options for January 2025 and 2026. While maintaining the current position might be a prudent choice, exploring other options could reveal opportunities for better returns.

Other January 2025 Options

Below is the new chart of 2025 January options for Mastercard:

Looks promising, right? The low implied volatility indicates that these options are relatively inexpensive. Let's delve into the potential returns with these options in play. Utilizing the consensus earnings along with high and low PEs, coupled with the analysts' target prices, we can generate a comprehensive chart showcasing the potential outcomes.

Whew, that is a big fella! What's evident is that if developments align with my projections, there are several favorable outcomes. However, if the trajectory aligns more closely with the analysts covering Mastercard's target, most options don't appear as appealing. In my opinion, targeting the 390 and 400 strikes seems prudent, as they would roughly break even if the stock hovers in the mid-$400 range next year, yet potentially double if it surpasses $500. Given the 22% increase in the stock this past year, a similar trend next year would place it at $513. Before rushing into decisions, let's assess how this compares to the 2026 options.

Looking at January 2026

Same thoughts as above but for another year out. Will mastercard make a good play? Let’s first glance at the options and see what they cost.

Pretty standard fare, no surprises considering the outlook for the January 2025 options. Now, let's embark on some distant projections. Assuming the company maintains the anticipated earnings growth of 20.8%, we can extrapolate next year's estimates to project a high of $17.69, a low of $15.96, and a consensus of $17.20. We'll model the current PE valuation of 36.5, but also consider 38 if conditions improve or a conservative 35 if they unexpectedly worsen. What would this scenario look like?

It appears probable that the stock will trade north of approximately $560. The upper end could reach as high as $670. Let's replicate the chart from earlier, considering the worst-case scenario of $558.52 with the consensus steady PE, resulting in a stock value of $627.87. Lastly, we'll explore the best-case scenario of $672.03. Brace yourself, as this chart is quite big.

In this analysis, it's evident that in almost all scenarios, the options perform exceptionally well. Even in the lowest end of the spectrum, most options yield around 80% total returns over two years. If conditions improve, it could easily result in tripling or more. The sweet spot on the chart lies in the middle with the strikes I favor the most. They have the potential for 99% returns on the lower end of the stock price estimate and could double or triple if conditions improve. As the strike price increases, the upside becomes even more significant, but the risk of being left in a challenging position if things worsen is also higher. In this context, I particularly like the $430s. They have the potential to double to quadruple, with my most likely projection showing a triple – a favorable position to be in.

New to the Board

Based on the detailed analysis above, I've decided to make two new additions to the board: the Mastercard January 2025 Strike $390, costing approximately $68, and the January 2026 Strike $430, costing around $64.50. I also understand if anyone chooses to continue holding the original option from a year ago. While there's potential to lock in some gains and transition into something new with greater return potential, it's essential to recognize that excessive trading can be costly. Moreover, there's still a potential 80% upside with the existing option.

That wraps it up, my friends. After thoroughly examining the Mastercard options, I'm optimistic about the potential outcomes. The multitude of solid options makes me feel like I might be underselling the situation. Mastercard stands out as one of the most consistently growing high-quality stocks. If they maintain their performance as they have for the past few decades, our returns could be immense indeed.

Regards,

S.