Mastercard Options: Two Years of Success and a Look Ahead to 2027

From triple-digit returns to a promising new position, evaluating opportunities in Mastercard Options

Two years ago, I published my second-ever options rundown, focusing on Mastercard. At the time, I projected the stock price would range between $505 and $611 by January 2025. Now, with 42 days remaining until the January 2025 expiration, Mastercard is trading at approximately $527 per share.

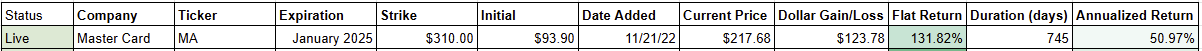

I modeled out options and demonstrated that most strikes would yield 100%+ returns at $505. I ultimately highlighted the $310 strike due to its attractive return profile. In November 2022, that option was priced at $93.90, and it’s now worth around $217.70—an impressive 132% return!

Last year, I revisited Mastercard and updated the projected stock range to $519.76–$541.12 for January 2025. Modeling the options from that point revealed multiple attractive choices. I chose the $390 strike to add to the scoreboard at a price of $68, with projected returns of 91%–122%. Today, that option is worth $138.25, delivering an even more impressive 103% return!

In both cases, I used Mastercard's projected earnings and historical valuations to accurately predict its trading range years into the future. Mastercard has been a consistently predictable stock from an earnings, growth, and valuation perspective for many years. This creates an environment where following the numbers gives you a reasonably high chance of being correct.

At a high level, I knocked this one out of the park. For the sake of my coverage, I’m marking these positions as closed. Now that I’ve shown how well things have gone, I’ll revisit my 2026 Mastercard projection and look even further ahead to January 2027!

Re-examining 2026

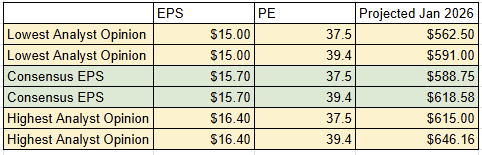

Looking ahead a year, I will model Mastercard's stock price based on price-to-earnings (P/E) ratios of 39.4 (5-year average/current) and 37.5, a valuation range observed in recent years. According to 35 analysts, the consensus estimate for Mastercard’s earnings is approximately $15.7 per share (with a low estimate of $15 and a high of $16.4).

To reach this projection, I am using the 2025 full-year estimates but excluding the final quarter of growth since the expiration date occurs before those earnings are reported. If Mastercard earns between $15 and $16.4 per share and trades at P/E multiples of 37.5–39.4, we can create a simple chart to evaluate its likely stock price range.

This analysis suggests a 12–18% increase in the underlying stock price is likely, aligning with the expected earnings growth of 12.5%. Using this projection and current options prices, we can model potential returns. For this, I am using the midpoint between the bid and ask prices for the options as of the market close on 15/2/2024.

After analyzing the chart, it's evident that while some returns are possible, they don't significantly surpass the potential returns of the underlying stock. Given the inherent risk of total loss associated with options, pursuing this strategy may not be worthwhile. Unlike last year, which presented multiple attractive one-year options, the current landscape lacks similar opportunities.

Reasoning:

In recent years, credit card companies like Mastercard have traded below their five-year average P/E ratios, allowing room for stock price growth through P/E expansion. Currently, the situation is reversed, with potential for P/E contraction, which could negatively impact returns.

Current Position:

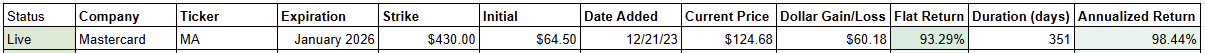

I'm not opposed to maintaining the 2026 option currently on the scoreboard, as it could yield additional returns from our entry point. However, at this time, I will not be adding any new positions for Mastercard 2026 options.

Looking Ahead to 2027

The final step in our Mastercard journey is evaluating the January 2027 options. Projecting one additional year of growth places Mastercard’s earnings per share in the range of $17.17–$18.40.

Using a broader range of P/E ratios to model the stock price, we see scenarios ranging from a worst-case scenario, where earnings grow more slowly and the P/E contracts to 36, putting the stock at $618, to a best-case scenario, where earnings growth accelerates and the multiple remains high, pushing the stock to $727.

I view the most likely outcome as falling within the middle of the earnings range and P/E valuations of 37.5–39.5. However, I’ll include the P/E of 36 in my modeling to provide a clearer picture of potential downside risk if things don’t go as planned.

This provides a modeling range of $638.64–$700.73, with the midpoint—and, in my opinion, the most likely outcome—being $665.25. The potential returns for these underlying stock values by January 2027 are outlined below:

This shows a 64–100% return in the more likely valuation range across several strike prices. Similar to Visa, I find this scenario workable, though it’s near the lower end of what I’d personally risk on an options play due to the potential for a total loss.

I will add the $510 strike to the scoreboard. This option offers a true double at the upper end of the range and approximately a 36% return at the lower end, which works for me.

Summary

Over the past two years, I’ve covered Mastercard and added options to my scoreboard of coverage. The January 2025 options delivered outstanding results, with returns of 131% and 103%—two slam dunks that are now closed! The January 2026 option I added last year is currently up 93%, with a full year of runway remaining.

Today, I re-evaluated the 2026 options and determined they’re not worth the risk at this time. However, looking ahead to 2027, there are some promising choices. To that end, I’ve added a new position to the scoreboard: $510 strike options for January 2027. This looks like a 60–100% opportunity.

Mastercard, you’ve been great to me.

Happy Investing,

S. Andrew

*Nothing sent out is meant to be financial advice, invest at your own risk.*

Disclaimer:

The information provided in this newsletter is for educational and informational purposes only and does not constitute financial or investment advice. Options trading involves significant risk and is not suitable for all investors. It is possible to lose all or more than your initial investment. Please consult with a licensed financial advisor or other qualified professionals before making any investment decisions.

Assume the author currently holds options positions in all the securities discussed in posts or listed on the scoreboard. These holdings may influence the opinions and analysis presented in this newsletter. This disclosure is provided to maintain transparency and should not be considered a recommendation to buy or sell any securities.

Any projections, forecasts, or examples provided are hypothetical and for illustrative purposes only. Past performance is not indicative of future results. While every effort is made to ensure the accuracy of the information, it is not guaranteed to be complete, accurate, or up-to-date.

Links to third-party websites are provided for convenience only. The author does not endorse or take responsibility for the accuracy of third-party content. All models, tools, and content provided are for personal use only and may not be reproduced, distributed, or used for commercial purposes without permission.

The author assumes no responsibility for any losses incurred as a result of using the information provided in this newsletter. By reading this newsletter, you agree to these terms.